How to Send/ Receive Money Using UPI Without Internet in India

Launched back in 2016, USSD 2.0 was proposed as a convenient way for feature phone users to transfer money in India without an internet connection. Fast forward to 2021, the service now has over 80 partner banks, 13 languages, and four telcos (Airtel, BSNL, MTNL, Vodafone Idea) under its belt. So if you ever want to transfer money and don’t have a steady internet connection, you can use this nifty solution. We will teach you how to use the *99# service to send and receive money using UPI without an internet connection in India.

Transfer Money Using UPI Without Internet (2021)

The code to access NPCI’s USSD-based mobile banking service is *99#. To get started, open your phone’s dialer, enter this code and press the call button, and wait for the list of services to appear. The total amount you can send per UPI transaction is capped at is Rs. 5,000. The charge for the USSD service may vary based on the network operator, but TRAI has set a maximum limit of Rs. 0.50 per transaction. With that out of the way, let’s have a look at this Internet-free UPI money transfer service.

* List of Options Available in *99# Service

Send Money

Request Money

Check Balance

My Profile

Pending Transaction

Transaction

UPI PIN

* Supported Banks, Telecom Operators, and Languages

* List of Partner Telcos (October 2021)

These are the four telcos that support *99# service at the moment. As you can see, Reliance Jio is a notable omission and the service will not work if you are a Jio subscriber, at least for now.

Airtel

BSNL

MTNL

Vodafone Idea

* List of Partner Banks (October 2021)

You can check if your bank supports NPCI’s *99# service in the list below. Do keep in mind that this list is updated as of October 2021. New banks may join the service in the future, so make sure you check the official list if you’re reading this after several months.

- Axis Bank

- Andhra Bank

- Karnataka Bank

- Union Bank of India

- Vijaya Bank

- Punjab National Bank

- YES Bank

- IndusInd Bank

- Bank of Maharashtra

- The Thane Janta Sahakari Bank Ltd(TJSB)

- The Ratnakar Bank Limited

- ICICI Bank

- Canara Bank

- UCO Bank

- South Indian Bank

- IDFC

- IDBI Bank

- Allahabad Bank

- Kotak Mahindra Bank

- Bank Of Baroda BARB

- HDFC

- State Bank Of India

- Dena Bank

- Karur Vysaya Bank

- Standard Chartered

- Indian Bank

- Ujjivan Small Finance Bank Limited

- Federal Bank

- Paschim Banga Gramin Bank

- Sarva Haryana Gramin Bank

- AU Small Finance Bank

- Himachal Pradesh Gramin Bank

- Jana Small Finance Bank

- Central Bank of India

- Syndicate Bank

- Indian Overseas Bank

- Bank Of India

- Punjab and Sind Bank

- City Union Bank

- The Lakshmi Vilas Bank Limited

- G P Parsik Bank

- Vasai Vikas Co-op Bank Ltd

- Thane Bharat Sahakari Bank

- Apna Sahakari Bank

- Janta Sahakari Bank Pune

- Rajkot Nagari Sahakari Bank Ltd

- Punjab and Maharastra Co. bank

- Jammu & Kashmir Bank

- The Mehsana Urban Co-Operative Bank

- Bandhan Bank

- The Saraswat Co-Operative Bank

- The Kalyan Janta Sahkari Bank

- Kallappanna Awade Ichalkaranji Janata Sahakari Bank Ltd.

- The Gujarat State Co-operative Bank Limited

- The Hasti Co-operative Bank Ltd

- The Mahanagar Co-Op. Bank Ltd

- Airtel Payments Bank

- J & K Grameen Bank

- FINO Payments Bank

- Kerala Gramin Bank

- Pragathi Krishna Gramin Bank

- Karnataka vikas Gramin Bank

- Andhra Pragathi Grameena Bank

- Prathama Bank

- Maharashtra Grameen Bank

- Purvanchal Bank

- Rajasthan Marudhara Gramin Bank

- Telangana Gramin Bank

- Chhattisgarh Rajya Gramin Bank

- Saurashtra Gramin Bank

- Andhra Pradesh Grameena Vikas Bank

- Uttarakhand Gramin Bank

- Meghalaya Rural Bank

- Mizoram Rural Bank

- Vananchal Gramin Bank

- Baroda Rajasthan Kshetriya Gramin Bank

- Dena Gujarat Gramin Bank

- Chaitanya Godavari Grameena Bank

- Baroda Uttar Pradesh Gramin Bank

- Baroda Gujarat Gramin Bank

- Dhanlaxmi Bank

- Punjab Gramin Bank

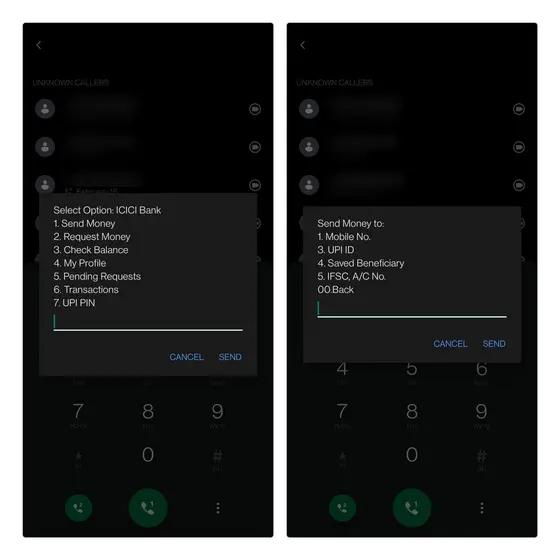

Send Money Using UPI Without Internet

1. Dial *99# and type ‘1’ to access the option to send money to others. You can send money by entering the mobile number, UPI ID, picking the saved beneficiary, or the account number with IFSC code. Type the number corresponding to the method you want

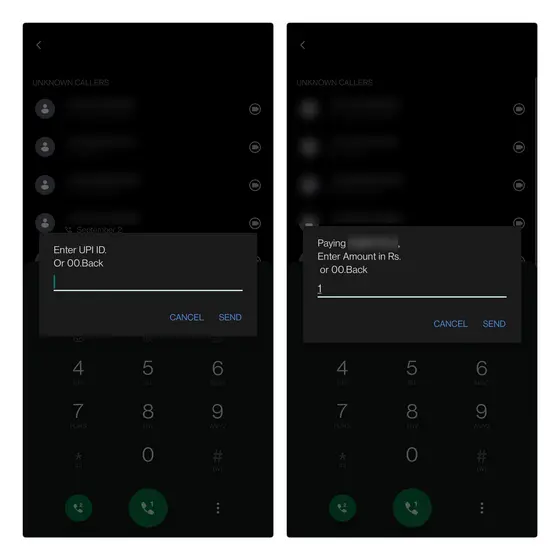

2. Enter the UPI ID of the recipient and press ‘Send’. On the next screen, add the amount you would like to transfer to their account using UPI. Here, I have entered Re. 1 for demonstration.

3. Add a remark if you prefer or type ‘1’ to skip. When the next pop-up appears, enter your UPI PIN to initiate the transaction.

4. You will now see a confirmation pop-up indicating that you have successfully transferred the money to the recipient, all without having internet access. Yeah, it’s that easy.

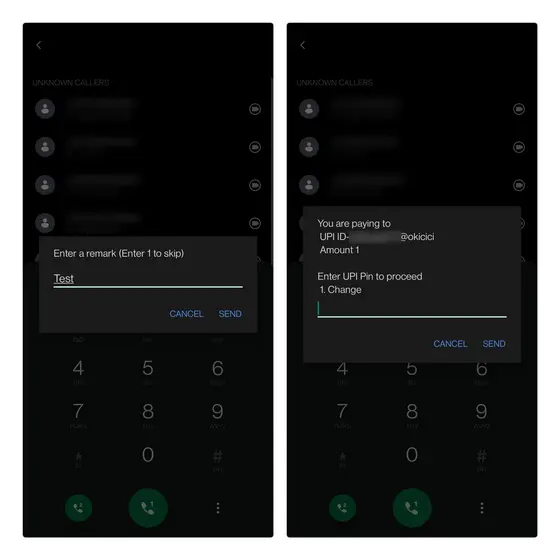

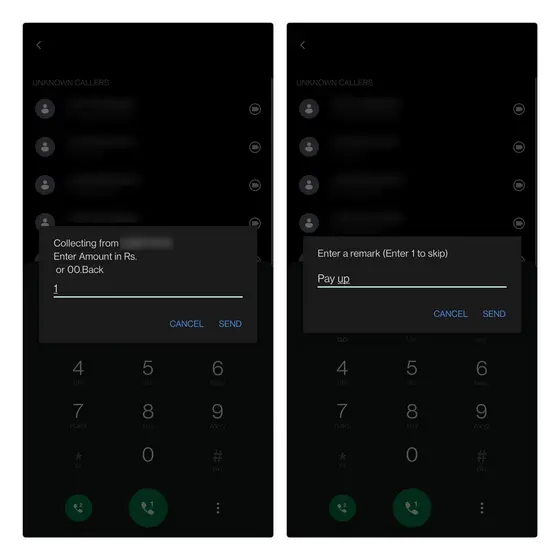

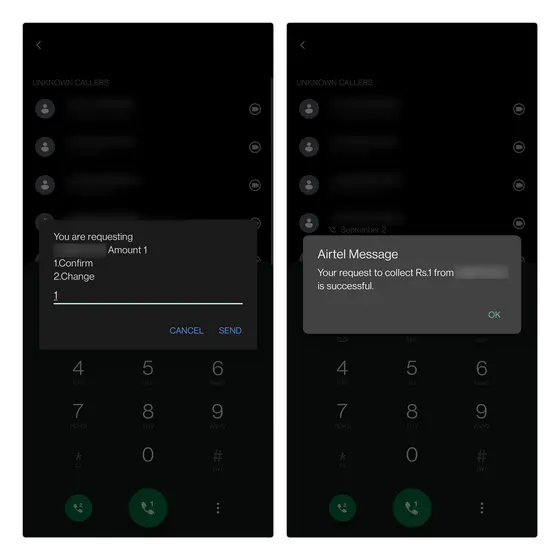

Request Money Using UPI Without Internet

Apart from the ability to send money using UPI without an internet connection, you can also use the *99# USSD service to request money from others. Here’s how it works:

1. Choose ‘Request Money’ by entering ‘2’ in the *99# pop-up and enter the mobile number or UPI ID of the person you would like to request money from on the next screen.

2. Enter the amount you would like to request and optionally add a remark if you prefer.

3. Up next, you will see a screen that asks you to confirm the payment request. Send ‘1’ to confirm. You will then see a message stating that you have successfully initiated the collect request.

Check Bank Account Balance Using USSD

Another convenient option under the *99# service is the ability to check your account balance. After you dial *99#, send ‘3’ from the main pop-up menu, and you will see the balance of the bank account linked to your phone number. Even if you are not interested in the ability to send money using UPI, the ability to check your bank account balance without an active internet connection is a nifty addition to the USSD service.

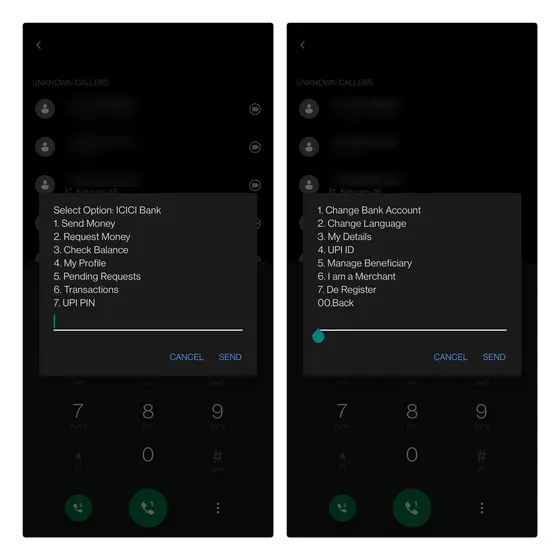

Manage Your Profile*

From the ‘My Profile’ section, you will see a plethora of options, and we have listed them all down below:

Change the bank account linked to your UPI number,

Change language,

Manage beneficiary,

Check your UPI ID,

Merchant features, and more.

Pick the number corresponding to the options listed above to manage your profile accordingly.

Check Recent Transactions

You can also see a list of your recent transactions using this USSD service. Send ‘6’ from the home menu to view your recent transactions. However, do keep in mind this only applies to UPI transactions (money you send and receive) via the USSD service without internet. Other transactions from UPI apps or different payment modes are not recorded here.

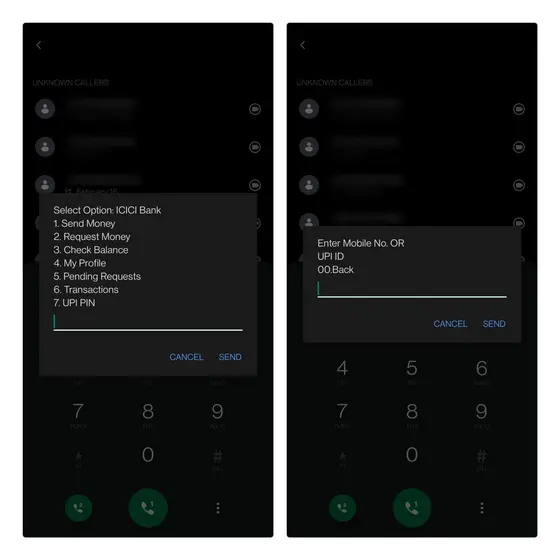

Change UPI PIN

Lastly, you can use the *99# USSD code to change your UPI PIN without an internet connection. Send ‘7’ from the main menu to set, reset, or change your UPI PIN. As you can see in the image below, there are separate options to change or reset your UPI PIN.

Make UPI Transactions Without Internet in India

So that’s how you can send and receive money without an internet connection using UPI in India. If you prefer using a dedicated app for all your UPI payments, do not forget to go through our list of the best UPI apps in India. One likely issue that you may run into while using the service is the “External application down. Please try later” error. However, trying the service after a few minutes fixed it on my end. In case you face any other trouble using the *99# service, let us know in the comments below. We will try to help you out.

Source : beebom